So if you want to keep track of how much you’re spending on something like gas or groceries, consider adding the category as a budget and then choose how much money you want to stay under each month.

APPLE MINT APP FREE

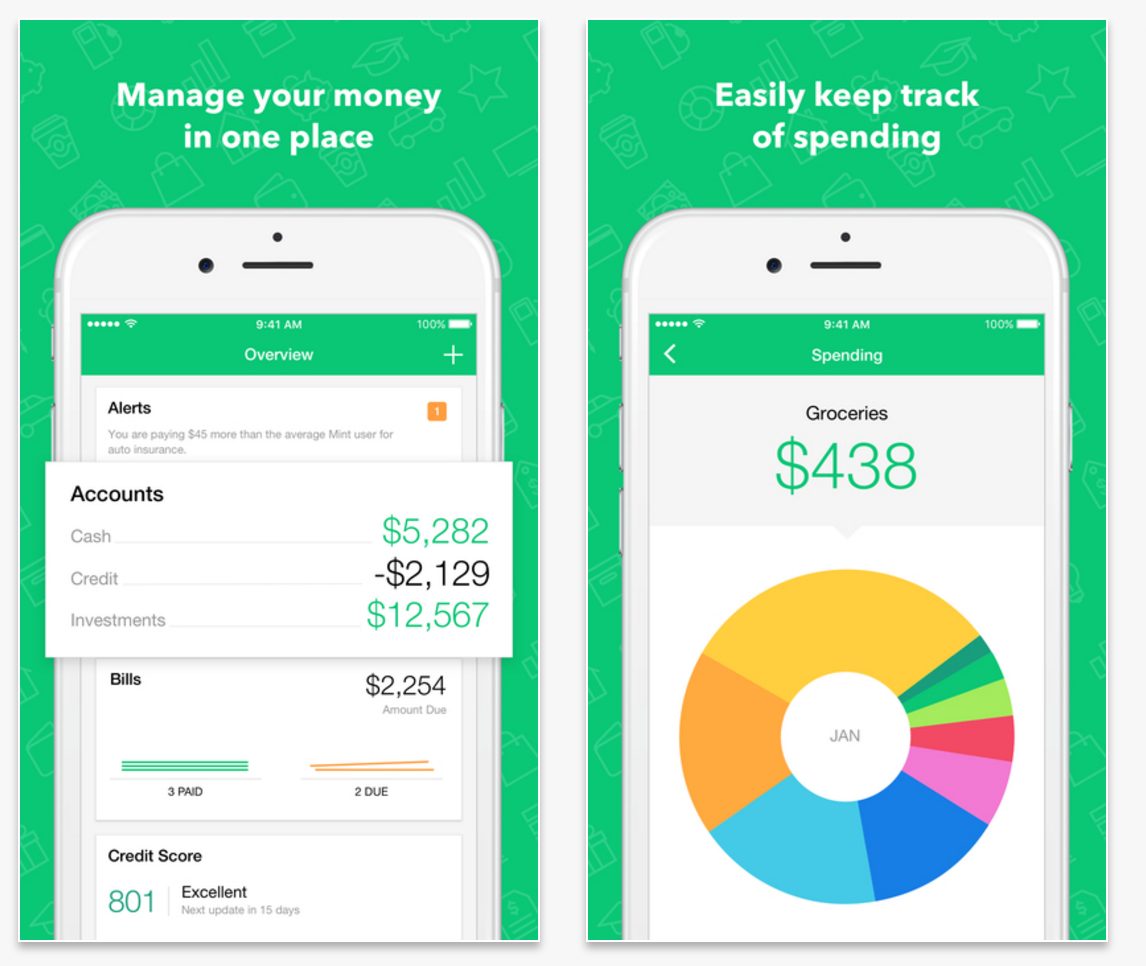

Budgeting: Both apps offer free budgeting services if you want to cut down on your spending in one or more categories.Everything’s in one place with Rocket Money and Mint, so there’s no wasted time navigating between different financial institution and card issuer websites. This can be helpful if you have multiple bank accounts and credit cards you’d like to keep track of, especially if you’d typically have to access them through different online accounts.

APPLE MINT APP FULL

This area gives valuable information on different types of financial products you might find helpful, including credit cards, personal loans, life insurance, and more. And if you’re interested in deals on credit card and loan products, Mint offers those as well.įor more help with saving money, be sure to browse the “ways to save” tab in Mint. In addition, Mint makes it easy to check your credit score at any time and keep track of the factors affecting your credit. And because the app is free, there’s no stress about an added cost when you’re trying to save money. Mint’s interface is simple and easy to use on either a computer or a mobile device. Mint is a budgeting app owned by Intuit that works to help you save money through creating budgets, setting savings goals, and keeping track of your spending in real time.

If Rocket Money doesn’t negotiate a lower bill, it doesn’t take anything from you. You can pay that portion with either a credit or debit card. This can help you locate any subscriptions you want to get rid of and you can also have Rocket Money negotiate any applicable bills that seem too high.īe aware, Rocket Money will take 30% to 60% of any savings it gets you when negotiating lower bills during the first 12 months of your membership.

However, a lot of the true value of Rocket Money may come from its other services, including locating your recurring bills and offering negotiating services to help lower your bills.įor example, the Rocket Money dashboard in your online account shows all the subscriptions and bills that Rocket Money finds in your connected financial accounts. If you want to create a budget to help reach your financial goals, this could be a good place to get started. Rocket Money (previously known as Truebill) is a free financial services app that could potentially help you save money through budgeting, lowering bills, and getting rid of unwanted subscriptions. Use the table below to see Rocket Money and Mint’s similarities and differences to see which app might align more with your financial goals.ĭesktop web browsers and mobile apps (Android and iOS devices)īudgeting, financial tracking, savings goals, checking credit score, bill negotiationīudgeting, financial tracking, savings goals, checking credit score, money-saving opportunitiesīudgeting, savings goals, and checking your credit score However, each app achieves this goal in different ways, so depending on what you need, you might prefer one app over the other. Both apps are designed to help you keep track of your finances and spending with the overall goal of helping you save money. Rocket Money and Mint are both considered free budgeting apps because they offer complimentary financial services to help with your budgeting needs, though Rocket Money offers optional paid features. They might also help you create and stick to a budget if you’re trying to save up money or pay down debt. The best budgeting apps can make it easy to quickly check your finances whenever you need to, whether from a phone or computer.

0 kommentar(er)

0 kommentar(er)